At the most basic level millennial distrust with the traditional banks has been borne out of the financial crisis of 2007/2008. For many this has stuck in their hearts and minds as being an incredibly challenging time both personally and macro economically – and not something that will be easily forgotten. There are a huge number of millennials that got caught up in the crisis through no fault of their own and found getting employment difficult, a step onto the property ladder impossible, and have had to put other plans such as raising a family on the back burner. These impacts are still being felt for many as they feel far worse off in their 30s than their parents would have been.

In the midst of the disaster, the regulators had to rethink the markets and in particular how they could get them to self-regulate again. They realised that the barriers to competition had been hugely harmful and what we had been left with was an overly powerful oligopoly. Whilst it had not had a primary strategic role in the industry previously, this is where financial software came into the limelight.

Is there more to the story?

The simple answer is yes – there is a far deeper story which helps us to understand why millennials are shunning traditional banks in favour of fintechs – and these are the characteristics of millennials which conflict with traditional banking:

- Millennials place importance on sustainable and ethical business. They shun those that abuse market position.

- Millennials are sceptical of Banks when they do run CSR campaigns as they still don’t trust their sincerity after the 2007/2008 crisis. They view banks as faceless corporations with no soul.

- Millennials view banks are solely profit making institutions – who will seek this profit at any cost.

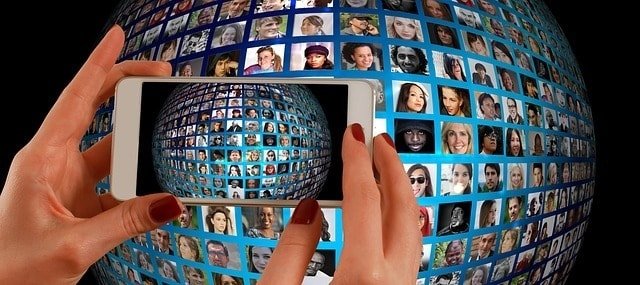

- Millennials want to bank whenever and wherever they desire. They want this to be a secure and tailored experience that they can access across multiple mobile devices.

- Millennials do not want to stand in queues in the high street banks.

- Millennials want to be able to bank quickly and easily and it is important that they have flexibility such as making quick transfers to friends through their mobile device.

In Summary

If we look at all of the millennial characteristics that conflict with traditional banking and we then map those to fintech offerings, it becomes fairly easy to see why millennials are favouring these new entrants.