When my grandpa required a loan he went to the bank, spoke to the officers, and deposited his income proof and thereafter a series of complicated procedure he was granted a loan from a financial institute of his choice. There are stories which are no longer an occurrence nowadays. There are millions of people who want a loan from banks or financial institutes and it’s sanctioned in minutes after giving information on your income. What works for easy loan disbursement is pure technology. In fact, it’s been replacing humans in this finance sector and found to execute faster and efficient job. We are generally curious to know how this had been possible so that the entire industry is depending on technology instead of human brains.

Technology that replaces humans: 21st century has seen various companies which has the minimum number of employees but its technology that does the major job of evaluation and disbursement of loans.

- Liquidity without bringing volatility: The main advantage of this procedure is that money is being sanctioned from one end and source and it’s being transferred to the other without creating a minimum cash crunch. Performance fees and redemption fees are lesser in this case.

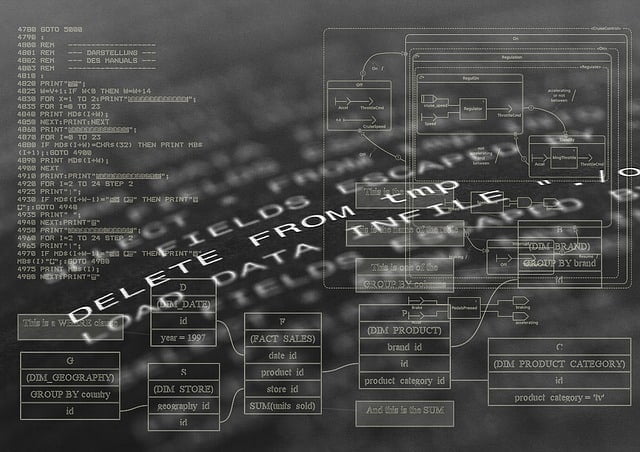

- Algorithms and statistical analysis: Of course the machine has to be really smart. The software designed for this particular reason is smart enough to read the data and analyze and finally, gives you the feedback whether to sanction loan to a particular individual after studying his credit report.

- Micro financing has been very popular in this aspect. Financial institutions are emphasizing towards micro-financing; advantages being that individuals opt for investment at a minimum rate of interest and this is accomplished when it’s disbursed to the other person who is ready to pay interest and his business becomes a great success.

- Mediator of the financial institutions is winners in this case: The financial institutions and the investors are both in win- win’ situation since technology does the real job making it easy for humans.

- KYC or know your customer technology: Banking and other financial services are using a technology to know their customer whereabouts and other details by this process; this helps to track customers and their financial details which are upgraded almost quarterly every year.

- OIX or open identity exchange is a technology where people can have trust others even in a crowded system as their details are displayed and can be tracked from the system thereby maintaining transparency to the highest level.

Software companies are working towards smart programs which are owned by a financial institution’s developed version of computer language made the job much easier.

Payments, insurance, and loans can be discovered and connected very easily when this technology is operational. Another aspect of this highly developed program is a security check. Loopholes are a check on a regular basis so that minimum cases of hacking are reported. There are various levels of security in this juncture.

The main technology used in this case is API ( application programming interface)and this has been the most popularly rated technology which allows bigger programs to run on windows platform; various financial institutions have reflected interest towards API and this runs successfully disbursing several loans every month.

Small investments or fixed deposits, term deposits, recurring deposits can be easily performed at the click of a button instead of wasting valuable time waiting in long queues.

Advantages of technology:

There are various advantages of using technology in the finance industry.

Disbursement of loans is quicker: Smarter companies invest more on technology than humans. The core points being machine can work tirelessly and thereby result in easy disbursement of loans in all sectors so that companies start earning at the minimum time frame.

The calculations are perfect and error free: when algorithms and facts are clear then calculations has to be error free thereby saving time on clarification on a single issue. It’s possible to focus on multiple issues instead.

Hazard free process, no queuing: Technology saves time and energy as well. The unnecessary queuing, time wasted in talking to people in person and understanding the clause are no more an occurrence.

Technology will help in collecting interest: Since disbursement of loans is easier, the collection is also done in a systematic fashion thereby cutting down effective time and focusing more on business.